With refinancing making up less than half of originations and a pivot towards the purchase mortgage market looming, BoldMortgage brings intelligent lead generation & software to the mortgage industry.

Propertybase, the leading global real estate and mortgage software company, today revealed BoldMortgage. Pegged as an industry-first, BoldMortgage marries the lead generation expertise of BoldLeads with the robust mortgage software capabilities of the Unify Business Growth Platform. This unique combination marks a new chapter in FinTech to solve the challenges facing many smaller mortgage brokers and loan officers with innovative technology.

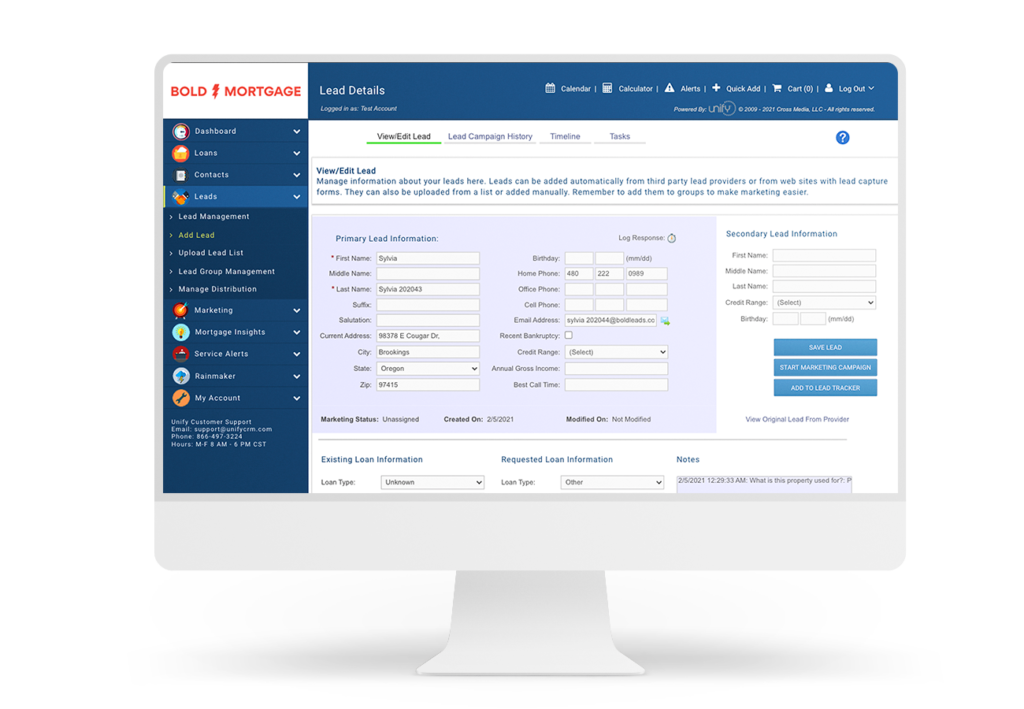

In today’s ever-evolving digital landscape, quality data is key to long-term success. BoldMortgage prequalifies prospects who provide consent. The seamless process instantly attaches information about the prospect’s credit standing to the data record within the Unify-powered BoldMortgage CRM – enabling lenders to make more informed, real-time decisions. In addition to the prequalification validation, BoldMortgage utilizes lead data augmentation to render even more valuable insights.

“Many mortgage brokerages understand the need to diversify their lead generation tactics. However, they struggle to implement anything of real value due to lack of available, compliant products,” said Tim Fessenden, Chief Product Officer at Propertybase. “As the refinance boom draws to a close, BoldMortgage will enable mortgage lenders to future-proof their business.”

BoldMortgage applies the unrivaled practices of the BoldLeads engine – long-touted for generating residential buyer and seller leads – with an optimized algorithm to specifically target refinance or new purchase borrowers. With proven advertising and landing page templates, as well as marketing experts to continuously monitor and optimize campaigns, lenders can save time and focus on closing loans.

BoldMortgage applies the unrivaled practices of the BoldLeads engine – long-touted for generating residential buyer and seller leads – with an optimized algorithm to specifically target refinance or new purchase borrowers. With proven advertising and landing page templates, as well as marketing experts to continuously monitor and optimize campaigns, lenders can save time and focus on closing loans.

BoldMortgage also offers an array of CRM features to spark conversations, digitize processes, and mitigate future risk. Key features include:

- Automated email marketing and drip campaigns

- Text messaging

- Video-based marketing

- Task and event management

- Lead scoring and prioritization

- A mobile app for iOS and Android

BoldMortgage packages start at 10 or 20 leads (prospects) a month. For more information about BoldMortgage visit getboldmortgage.com.