Propertybase is excited to announce the acquisition of Cross Media, LLC, producer of Unify, a full suite mortgage-specific Business Growth Platform.

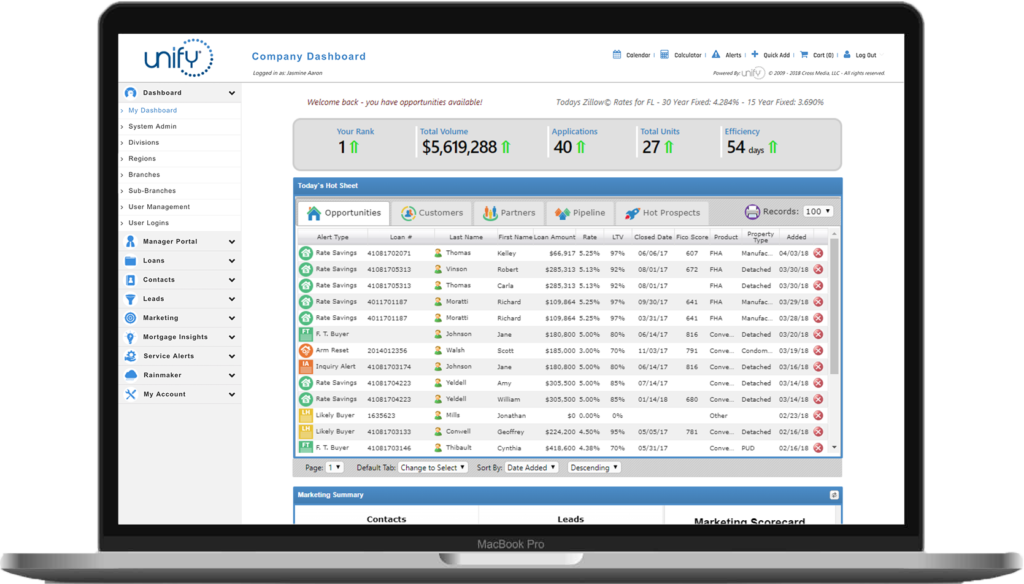

Serving more than 80 mortgage companies across North America, Unify offers a turnkey platform with the richest set of tools to identify and convert more leads and retain clients. The features consist of robust customer relationship management (CRM), real-time Loan Origination System (LOS) integrations, intelligent mortgage inquiry alerts actively mining potential borrower data, marketing automation, a mobile app and much more.

“After an extensive evaluation process to identify an authoritative market leader, we’re thrilled to welcome the Unify team into our Propertybase family,” said Vance Loiselle, CEO of Propertybase. “Unify’s differentiated product offering and commitment to exceptional service accelerates our plans to streamline how real estate and mortgage professionals can effectively use innovative digital solutions to drive revenue.”

Research suggests that it will behoove the industry to cooperate in tackling the ever-changing client expectations brought on by digitalization and consumerization. T3 Sixty’s 2021 Swanepoel Trends Report detailed the lucrative opportunity which exists to create cross-functional partnerships.

“T3 Sixty annually studies and analyzes the 10 most significant trends impacting the residential real estate brokerage industry. The 2021 Swanepoel Trends Report specifically identified a renewed focus on real estate’s ancillary services and the continued surge in capital investments into real estate technology. The acquisition of a mortgage technology company by Propertybase affirms both these two trends,” stated Stefan Swanepoel, Chairman & CEO of T3 Sixty.

“Unify was founded with the vision that software should play an integral part in the mortgage industry,” added Scott Lidberg, CEO and Founder of Cross Media, LLC. “Joining forces with Propertybase is an exciting achievement which will allow us to not only amplify our current client offerings but unlock cutting-edge potential for the entire industry.”

As part of the acquisition, the Unify product will continue to operate as an independent entity while continuing to be enhanced under the Propertybase family of brands.

From the very beginning, Propertybase’s vision has been to accelerate the use of technology across the entire industry, improving the customer journey and enabling our clients to grow in a digital-first world. We’re excited for this next phase of the journey!

Frequently Asked Questions

Quite the opposite. We believe that providing software and services to the mortgage industry only strengthens our focus and commitment to the entirety of the real estate transaction lifecycle. We believe we’ll be able to bring more data, insights and opportunities to all real estate professionals by virtue of our expansion into the mortgage industry.

From the beginning, the Propertybase vision has been to improve the industry’s complexities with innovative software. Accelerating the use of technology improves collaboration across services that will ultimately benefit the customer experience – your clientele – and provide your business with all the tools to excel in a digital-first world. In addition, we envision a future where Propertybase empowers its large and growing network of clients to foster relationships across the entirety of the real estate transaction.

In the very near future, we will be announcing a new product brand that encompasses our expertise in lead generation and mortgage software. This new product, built specifically for the mortgage industry, is just the start of the next phase in our vision to bring ancillary services and further collaboration across the entire customer journey. We’re very excited about what the future holds!

We will continue to generate exclusive buyer/seller leads for our BoldLeads residential agent/brokerage clients. Our mortgage lead generation will use similar algorithms to target refinance and purchase leads.